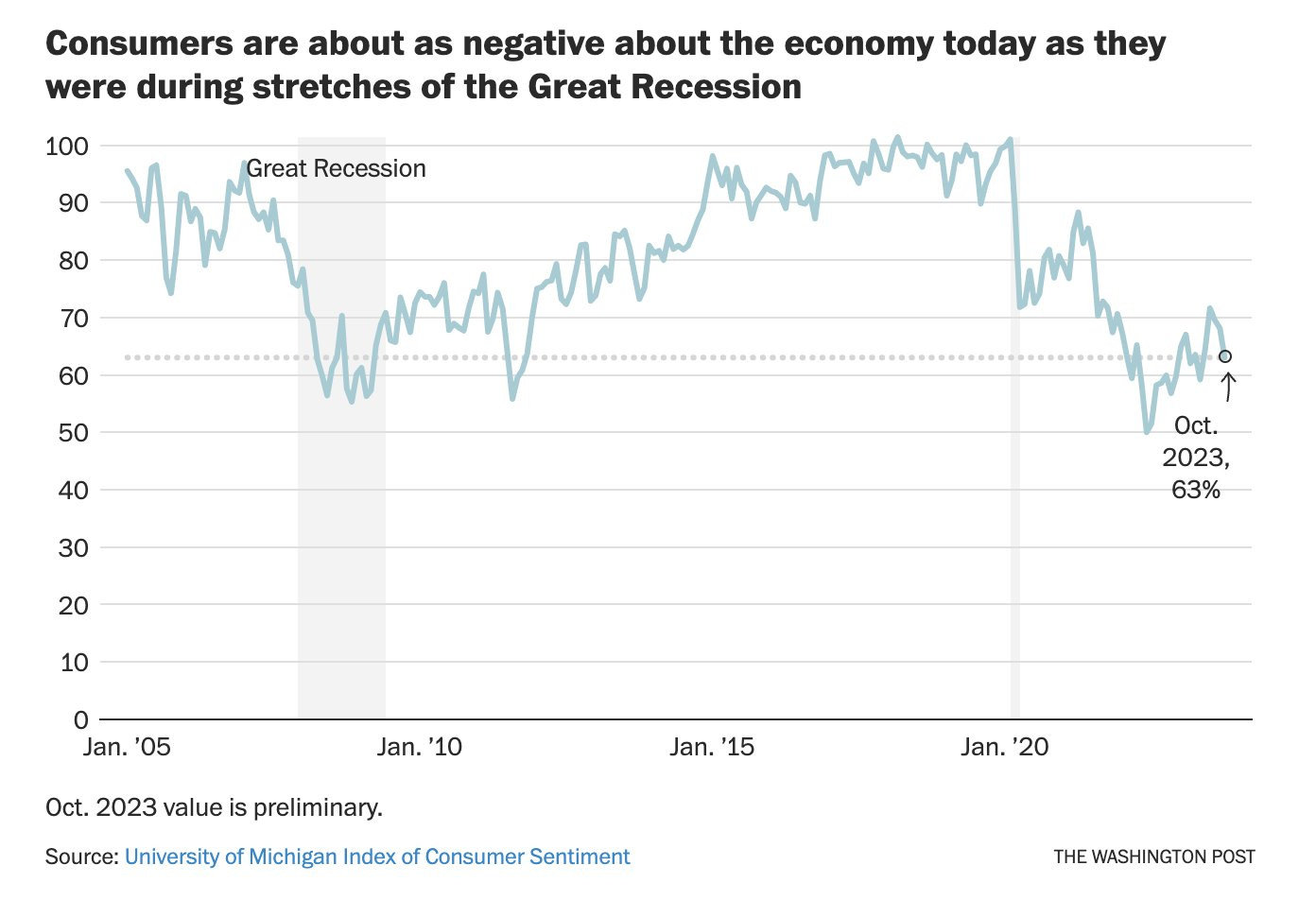

People think the US economy is historically bad right now. They're wrong: the economy is actually very good.

Well, what about the recession I keep hearing about? Around last year, lots of economists were predicting an imminent recession, but they were wrong.1 GDP growth has been above the long-term average for more than a year now, and it was double the usual rate last quarter. And that’s not just increasing off a depressed baseline; US GDP is now ahead of forecasts that were made pre-COVID.

Well, "GDP" isn't a thing you can actually experience. Aren't real people struggling? The unemployment rate has been at a 50-year-low. More than ever, if you want a job, you can get one.

Well, even if you can get work somewhere, aren't jobs unreliable? Layoff rates are historically low. Measures that include “unemployment”—people who want full-time jobs but can only find part-time work—are also historically low. And a recent study found that income volatility is at an all-time low; livelihoods are more stable than ever.

Well, even if things are good on average, aren't disadvantaged groups being left behind? Unemployment is near all-time lows for Blacks and for Latinos. Wages are growing fastest for non-whites and lower earners. On a different dimension, remote work has allowed many more mothers of young children to find employment. There are still gaps in outcomes, of course—but most are shrinking, not growing.

Well, even if people are earning more, don't they also have way more student debt? Overall, American wealth (assets minus debt) increased dramatically over the last three years. That's a statistic that can be skewed by a few really wealthy people, but in this case it isn't: wealth grew even faster for people with the least wealth (most debt) to begin with. (Somewhat related: the actual price to attend college has been falling since 2017.)

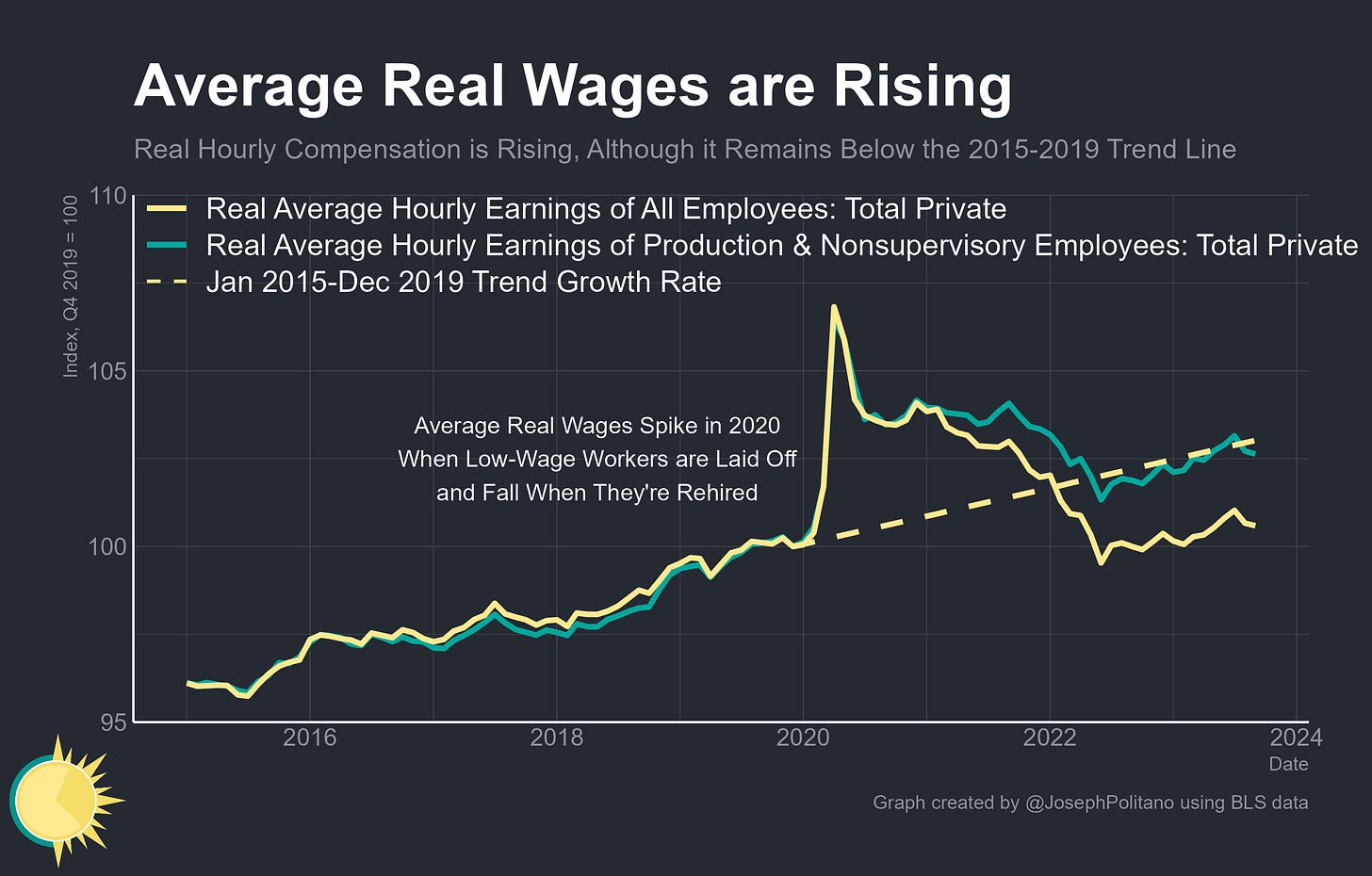

Well, isn't inflation making everything too expensive? That was indeed a major problem over the last couple years. But it's improving a lot: overall inflation is down to a slightly-high-but-normal level, and the most visible component (gas prices) has declined considerably. As a result, wages have been rising faster than inflation for a full year, and that's been especially true for low-earning workers. There's a good argument that policymakers need to do more to combat future inflation (and to talk more about what they've already done to fight it), but it's hard to say inflation is making things terrible today.

Things aren't perfect; some people are struggling, and they deserve better opportunities and support. But that's always been the case. The economy is better than it's been for most of the past, which is the only reasonable way to judge if it’s “good.”

Everything is vibes

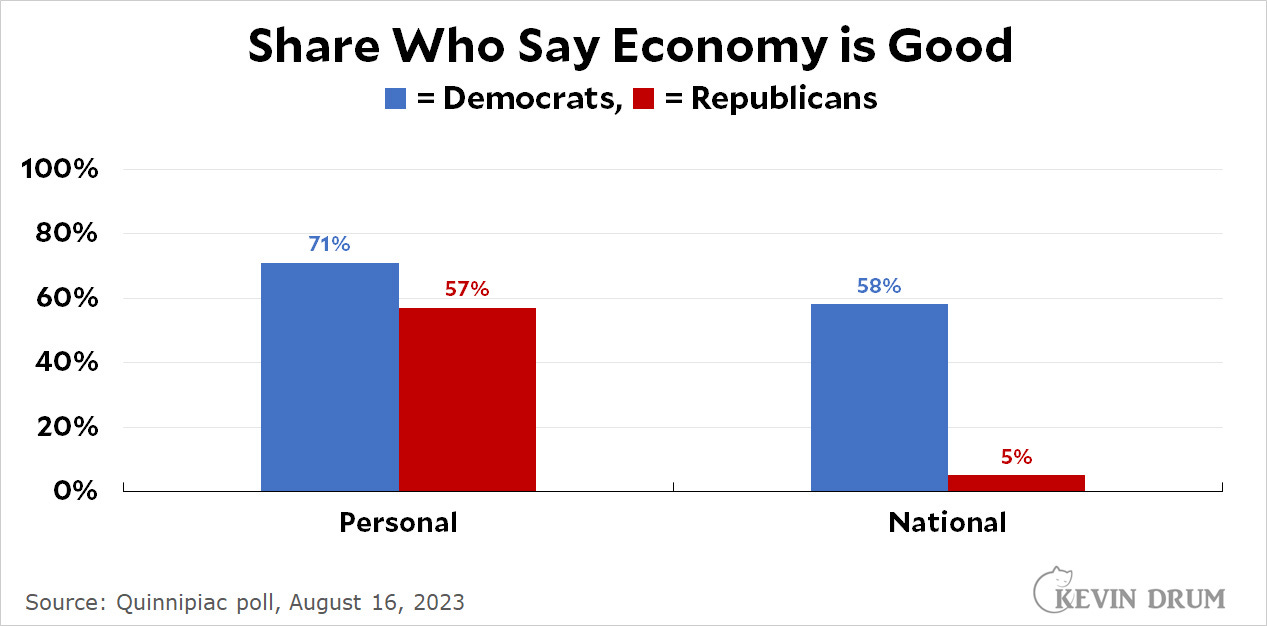

More evidence that things are good: even while they say "the economy" is bad, most people consistently say they are doing fine financially. Political polarization is part of the explanation—that gap is much larger among Republicans, who are probably just expressing disapproval with the Biden administration. But there's also some gap among Democrats.

I think that's because the vibes right now are all about problems. Downsides dominate a lot of technology discussion; economic headlines with good news inevitably contain caveats; people express less pride in being American. Some of these narrative corrections have been useful, especially when they highlighted problems that affected a minority but may have been invisible to others.

But they should come against a baseline of optimism, because optimism is self-fulfilling. If you think conditions are terrible, you won't take risks, and everyone will suffer; if you think things are good and future progress is probable, you'll strive to achieve it. So when things are mostly good, like the economy is right now, we should celebrate.

This is not a prediction!

Back when Sports Illustrated was a big deal, people talked a lot about the "SI cover jinx"—whichever player or team was on the cover of that week's issue was likely to disappoint shortly thereafter. It was fun to think of it as a mystical power, but it was really just regression to the mean: the cover featured whoever had been extraordinarily successful, which usually meant they had some good luck that wouldn't keep up.

For the same reason, any time you write about how something is very good or very bad, it's probably not going to continue and you're going to look stupid. So to be clear, I'm not saying that the economy will keep getting better in the future; I'm saying it's good right now.

By default, I think it's generally impossible to predict when things will get worse. I was unusually optimistic about the future last year because the labor market was really strong and people had built up a lot of savings during the pandemic, but now the labor market is showing a few cracks and it's less clear how much those savings have been spent down. I'm not saying things will get worse, but I'm back to the default position of having no idea whether things will get worse or better.

There was a big fall in the stock market last year, but that was driven by the expected value of future earnings, not current activity. And that's in the past; the S&P 500 is up 18% this year.

Very clear. It certainly feels like people are spending like crazy.