Five years ago this month, COVID-19 upended our lives. I spent most of 2020 researching the pandemic’s effects on business and society, which included reading a bunch of predictions about which changes would last and which would be temporary. I recently came across some links I’d saved and figured I’d plot how they panned out:

This isn’t comprehensive, and it’s inherently subjective, especially on the x-axis. (I’ve tried to ground the y-axis in data, but there’s some wiggle room in how to frame those too.) If you have arguments or other nominees, I’d love to hear them.

Deep-diving on a few interesting ones:

Work from home (seemed permanent, actually permanent): I think today’s return-to-office narrative is oversold. It’s hard to get a clear picture here because different measures vary, but government surveys show working from home increasing since 2022 (both as a share of workers who have the option, and as a share of total hours worked). And although new job postings have shifted back toward in-person, that’s mostly just because the WFH-friendly tech sector is hiring less; when controlling for the industry mix, remote postings have barely fallen.

Part of what’s going on here is that new companies are much less likely to be in-person they were before the pandemic, and that trend may even be accelerating: according to one survey, 57% of startups founded in 2023 were remote or hybrid, up from 35% in 2021. So although you’ll see headlines about older and bigger companies bringing workers back to the office, that’s offset by the small but growing cohort of new businesses.

Business travel (seemed moderately permanent, actually moderately permanent): This is one of the few I could find concrete data for on both dimensions. Industry groups claim US business travel is back to record highs, but those numbers aren’t inflation-adjusted; even taking their estimates at face value, they’ve grown 10% below inflation since 2019. Furthermore, business travel spending was growing at 1-2% in real terms before the pandemic, which means it’s more like 20% below the projected trend. And for all the rhetoric about how all meetings would happen on Zoom forever, businesses actaully projected in a mid-2020 survey that their long-run travel spending would fall by about 30%—pretty close to what actually happened.

E-commerce acceleration (seemed permanent, actually temporary): In the first months of the pandemic, people stopped going to stores and started ordering things online; prompting a lot of talk about how these new habits would stick and the future of e-commerce was permanently brighter. Five years on, people are definitely buying more online, but almost exactly the level you would have predicted by just extrapolating the pre-pandemic trend:

In contrast, the curve for online groceries seems to have shifted more permanently; I couldn’t find good US data, but in the UK and worldwide it’s still 1-2pp above the trendline.

Gig economy (seemed ambiguous, actually temporary): As a lot of laid-off workers turned to non-traditional platforms to earn money in 2020, and others got bored while working from home alone, some wondered if we were seeing a permanent shift away from full-time employment. No matter how you define it, this hasn’t really happened:

If you look at all freelancers and contractors, they represent the same share of all workers as they did in 2019 (about 10%).

If you look at specifically who earns on “gig platforms” (ridesharing, delivery, social commerce), it’s up from 3% to 4%, but flat in the last three years.

Despite what you’d expect from scrolling Reels or Tiktok, the share of “content creators” is a rounding error at 0.2% and has been declining since 2021.

And even among those gig workers, less than a quarter actually work on gig platforms year-round.

If you like Google Trends, searches for “gig economy” are below pre-pandemic levels, which matches my sense of the zeitgeist.

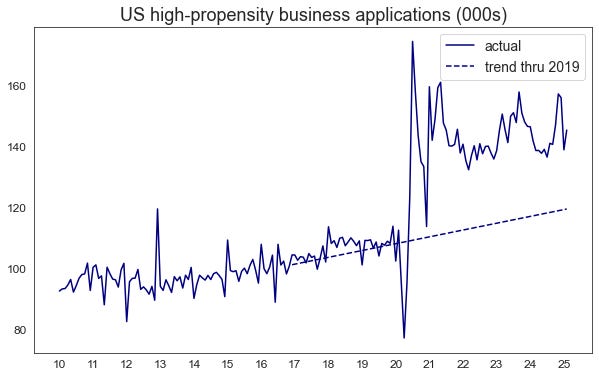

Startup boom (seemed temporary, actually permanent): There were a lot of weird economic indicators in the early months of the pandemic. Most of these were easy to explain, but a slightly puzzling one was that new business applications went through the roof. (These aren’t necessarily what you think of as “startups”—most of these are small businesses, not venture-capital-backed tech companies.)

You could tell a lot of temporary stories about this: maybe people put their stimulus checks into getting a business off the ground; maybe they were laid off and had nothing better to do; maybe they were committing fraud for PPP loans. But five months on, new company formation has remained way above pre-pandemic levels:

Usually a permanent break in a trend like that isn’t real; it means the data provider changed how they measure it, or people found a way to game the system, or something like that. But I really couldn’t find any theories for why this data is skewed—which means people are actually starting a lot more new businesses. Maybe that’s to take advantage of all the other trends on the chart, and/or maybe it’s being propelled along by the recent AI boom.

One caveat is that these new companies tend to employ somewhat fewer people and may be more likely to go out of business sooner. But as long as there’s more of them, that’s not necessarily a bad thing.

==

One thing I didn’t put on the chart, because I don’t think we know yet0 how it’ll play out, is the technological advances in pandemic prevention. It’s safe to say that we aren’t investing as much toward fighting the next outbreak (in dollars, regulations, or mindshare) as we expected from the vantage point of mid-2020. But if COVID-19 was just the tip of the iceberg for what new vaccine technology can do, or if innovations like germicidal UV light dramatically reduce transmission, we might still be much better prepared for future threats.

I don’t really think the evidence behind the other items is worth reading, but if you’re curious or want to argue about it, see this long footnote.1

Telehealth (seemed permanent, actually permanent): This hasn’t been as permanent as some might have hoped; the latest data I could find was from late 2023, which showed a slight decline from even 2021-22 (and naturally a large decline from 2020). But it’s still up more than 10x from before the pandemic.

Acceleration of superstar companies (seemed permanent, actually permanent): In 2020, the top five companies’ market value rose to 23% of the total S&P 500, a three-decade high. That’s probably because the biggest tech companies were winners of the shift to more digital work and entertainment, but there was also precedent for crises consolidating industries: the Great Depression helped winnow a fragmented US auto market to the big three, and large companies are more likely to innovate during economic crises. Indeed, the top five companies have since grown further to 26% of the S&P 500.

Disappearing snow days (seemed permanent?, actually permanent): This is more of a lark but ChatGPT says 60-70% of districts go to remote schooling when it snows now. I’m very open for debate about where this belongs on the x-axis.

Direct-to-streaming (seemed ambiguous, actually temporary): Producers have shortened the exclusive theater window from 90 days before the pandemic to 30-45 now. But major releases generally aren’t on streaming from day one the way they were in 2020-21.

Pandemic preparedness (seemed permanent, actually temporary-ish): It’s not fair to call this completely temporary; the Biden administration made some positive strides in recent years, launching ARPA-H with a billion dollars of funding, spending hundreds of millions on mRNA flu vaccine programs, and expanding disease surveillance programs. But those investments are probably at least an order of magnitude less than we’d hoped for during the pandemic, and perhaps less imaginative too. This might move further down the y-axis soon if the Trump administration effectively bans funding for mRNA research.

Outdoor dining (seemed permanent, actually ambiguous): NYC had 3,000 outdoor cafe applications in 2024, down from 11,000 at the pandemic peak but up from 1,000 before it. I may be shortchanging this one, but I felt like the expectations were higher than that—and it doesn’t really seem like even the current level will hold, since the city seems to be dragging its feet on its new approval process this year.

“Stakeholder capitalism” (seemed temporary, actually temporary): Early in the pandemic, public health challenges trumped economic concerns for most companies. Some claimed this would mark a permanent change in corporate culture, in which social concerns would outweigh shareholder value; these takes were pretty speculative, but there were a lot of them. This isn’t exactly the same as “ESG”, but it follows similar themes; it had a decent run for a few years but the pendulum is swinging back now. I’m actually quite bullish on the role business will play in solving societal problems like climate change, whether or not it’s wrapped up in explicitly “stakeholder-based” rhetoric, but the seeds of that were already planted in the years leading up to COVID-19.

Livestreaming (seemed temporary, actually temporary): It’s unfair in some ways to just point at Clubhouse’s $4 billion valuation, but it’s also funny.

Cooking at home (seemed temporary, actually temporary): COVID-19 reversed Americans’ tendency to eat out more over time, and there was maybe a fringe idea that meal prep would be a permanently larger market, but as most of us expected it bounced back to trend by 2023.(There has probably been a permanent shift away from dining in restaurants and toward takeout, but I can’t find any good data on that.)

Personal travel (seemed temporary, actually temporary): Not all of the world is fully back yet, but US international travel is healthily above its 2019 level.

School absenteeism (seemed temporary, actually permanent): Chronic absenteeism has increased by 10pp from pre-pandemic levels, and it’s come down only slightly since 2021-22, so there’s no real reason to think we aren’t at a new (bad) steady state. You could put declining test scores in this bucket too, but I don’t think we quite know yet how permanent they are and whether it’s just a consequence of absenteeism or if there’s more to it.

Anti-establishment vibes (seemed temporary, actually permanent): See all the incumbents losing in 2024 elections, which weren’t necessarily about the pandemic, yet seem downstream of it in a larger sense.

Interesting

The school absenteeism is a real concern. This is a subjection opinion. After the isolation of home schooling, my DIL said her children and the children in their schools are getting more strep, more URI, etc since they are back to school. Sort of like they did the first 3-5 years of being with other kids on a daily basis. Hopefully this ends soon as the immune systems kick in.

My grandchildren have not yet had one remote day of school for snow. They still build in 4 days and this year they haven't used four. Maybe if they used all four school would try to go remote for the overage.